Pay raise calculator with overtime

35 hours x 12 10 hours x 15 570 base pay 570 45 total. Of regular hours Regular rate per hour-Overtime gross pay No.

Hourly To Salary What Is My Annual Income

45750 per week 4575047 973 per hour Then when calculating overtime you should keep in mind that it starts at 40.

. Add the overtime pay to the employees standard pay. Normal or standard pay rate ----overtime - time and a half 15 ----overtime - double time 2 ----overtime - triple time 3 ----overtime - quadruple time 4 ----. Use monthly gross payment amount.

If you enter a dollar amount. Note that the employee should receive the total payment on their usual payday. Enter your current pay rate and select the pay period.

Of regular hours Regular rate per hour-Overtime gross pay No. Of overtime hours Overtime rate per hour-Double. 1000154 1500 4 6000.

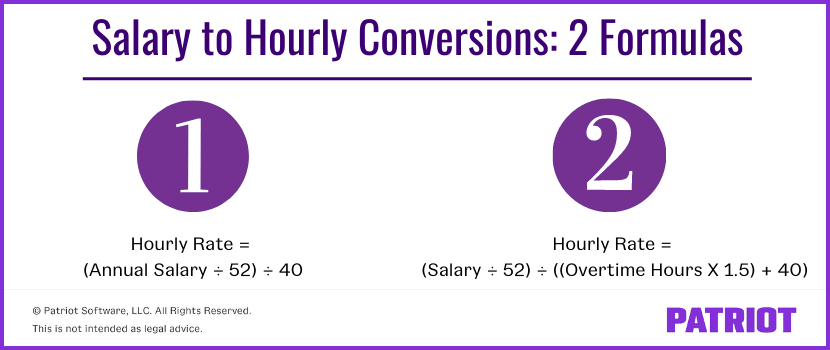

Divide the weeks pay by the number of hours worked ex. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for.

The overtime calculator uses the following formulae. Depending on the employer and its incentive policy the overtime multiplier may be greater than the laws. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA.

Next enter the hours worked per week and select. In case of the first tab named Gross pay. Enter your hourly pay rate.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. This employees total pay due including the overtime premium for the workweek can be calculated as follows. 35 hours x 12 10.

This online pay raise calculator will calculate your pay raise or cost of living COL raise based on either a dollar-amount increase or on a percentage increase. Unless exempt employees covered by the Act must receive overtime pay for hours. 8000 6000 14000.

Divide the employees daily salary by the number of normal working hours per day. RM50 8 hours RM625. The overtime calculator uses the following formulae.

-Regular gross pay No. Enter your pay band number Enter S if youre in an Occupational or GovEx pay band Your total percent increase Your new hourly pay rate. One day this employee works overtime for a total of 2 hours.

Calculate overtime pay for a monthly-rated employee. Follow the simple steps below and then click the Calculate button to see the results.

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Pay Raise Calculator

Overtime Calculator Clicktime

Salary Overtime Calculator Calculate Time And A Half Double Time Wages

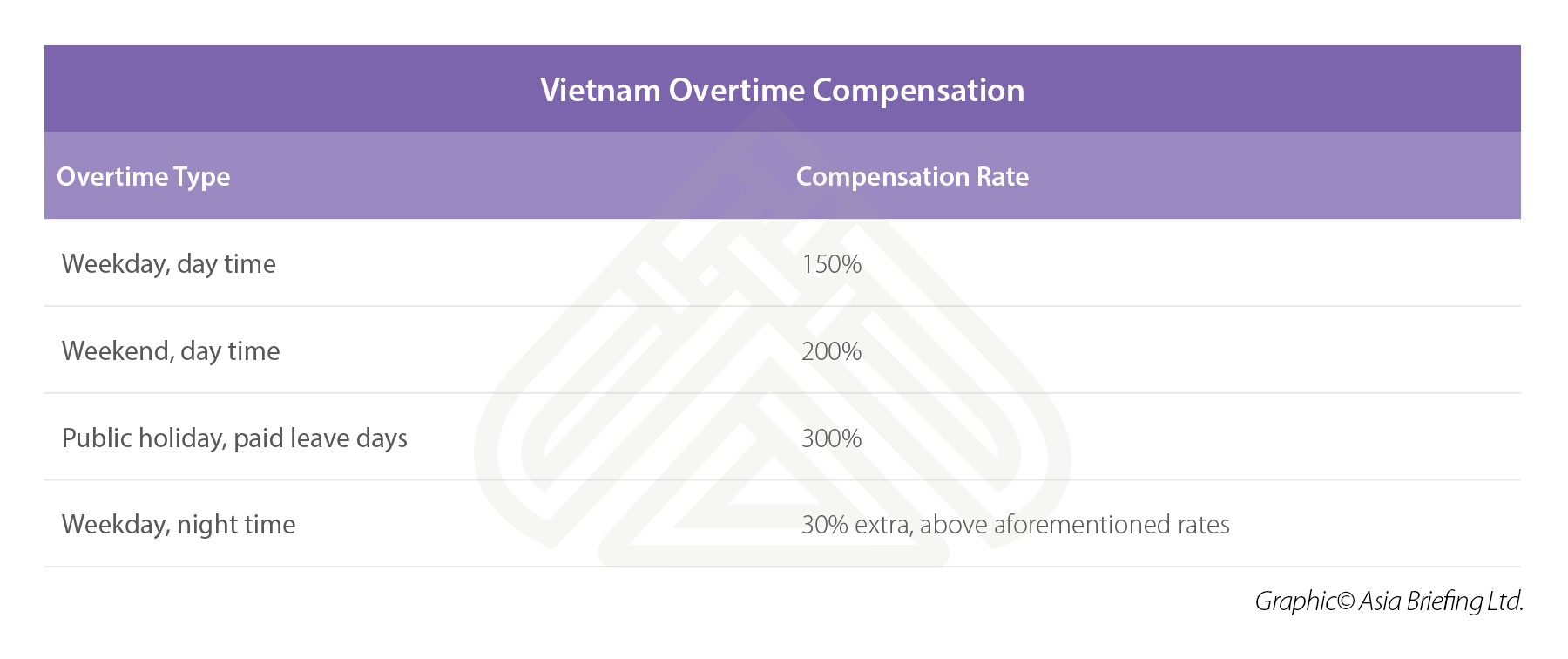

Payroll In Vietnam A Guide To Compensation Bonuses And Benefits

How To Convert Salary To Hourly Formula And Examples

Download Employee Ta Reimbursement Excel Template Travel Insurance Payroll Template Excel Templates

A Good Business Credit Score Can Help You Gain Capital To Grow And Help You Borrow Funds When Cash Is Low Credit Score Financial Strategies Payroll Software

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Hourly To Salary Calculator Convert Your Wages Indeed Com

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

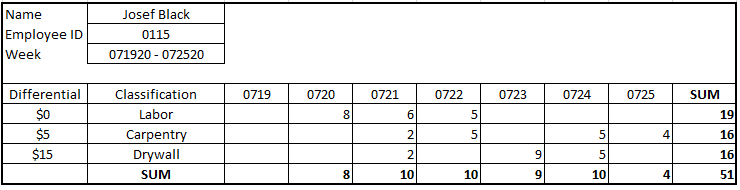

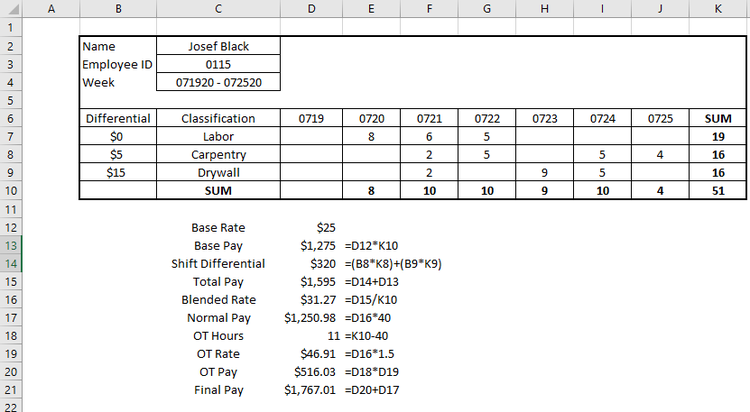

How To Calculate Blended Overtime In 2022

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Calculator

How To Calculate Blended Overtime In 2022

How To Calculate Overtime Pay For Hourly And Salaried Employees Article